The need for more efficient and cost effective money payments & remittances methods globally keeps growing as the mobility of the people keeps increasing thanks to more convenient transportation options available around the world. International money transfers have evolved over the time and have come a long way with the help of incredibly innovative financial technology or fintech. New technologies and methods have made these processes easier than ever.

Turning back the lane the history of money transfers dates all the way back to thousands of years. People first exchange goods or services when there is no presence of money. It was later replaced with coins or other sorts of currencies.

With the development of banks and other financial institutions the transferring money across the countries became easier and more common favoring more international trade.

In the 20th century after the invention of the internet and mobile phones money transferring methods became more advanced. Electronic money transfers became more popular over the traditional banks due to their advanced features. Global money transfers have never been easier with many digital apps that offer global digital payments fast and cost effectively. Anyone with access to the internet and a smart device can transfer money around the world without even stepping out from their house.

Growth of Payments & Remittances

On the other hand, remittances have become one of the important sources for economic development in many emerging economies. Modern technological advances have made it so convenient to transfer remittances within a few hours to any part of the world. Revolution in the international money transferring industry due to rapid growth in technology has overtaken the traditional processes and services. Contactless or mobile payments, digital wallets and the availability of real time foreign exchange (FX) rates have transformed global money transfers into an activity that is secure, efficient, and responsive.

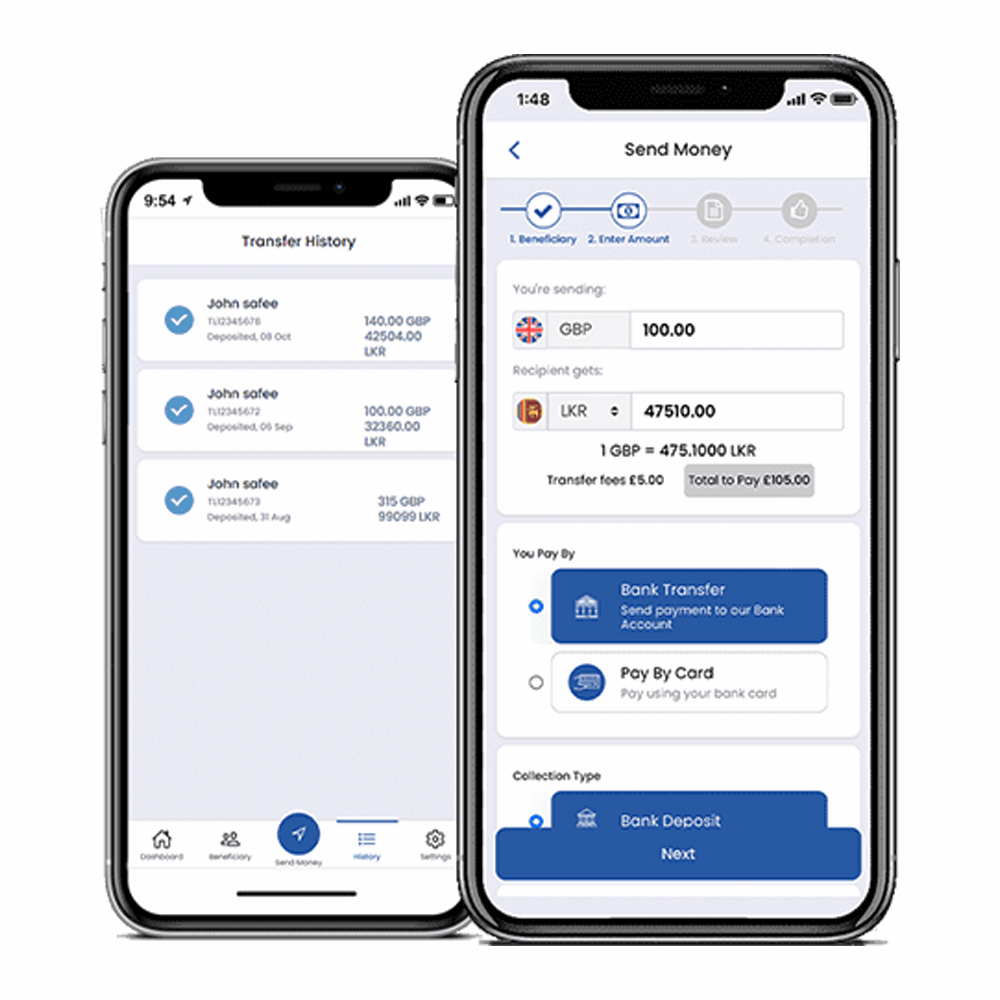

The newest or the latest trend in money transfers are contactless or paperless money transfers. When people started using more smart devices like mobile phones and surfing in social media all the time these transactions too became more popular for all the tech savvy people. Recent covid 19 pandemic turned more people towards contactless or cashless money transactions as money became one of the main causes for spread of the virus. One of the biggest players in contactless international money transfers is the Teeparam Exchange Limited in the UK.

Teeparam app is one of the fastest, safest and reliable sources for contactless money transfers around the world. With many added benefits Teeparam handles many bulk transactions daily around the globe. It is a clear fact that the private sector plays a major role in the development of international money transfers. But still the governments have all the authority for the flow of the money around the world. Therefore, the future of the global money transfers will largely depend on the government policies and regulations.

For example, Brexit hugely impacts the free flow of money between the UK and Europe. So it is clear the future trends of money transfers and remittances will depend on the new technology, increasing migration of people and the policies and regulations implemented by the governments. The growth of these industries will continue providing more reliability and cost effective ways to transfer money around the globe.

Role of Digitization – Payments & Remittances

As the global immigration numbers keep adding up, payment processing has become one of the important parts in day to day business no matter what size the business is. With the payment card options it has become more cost effective and convenient to the people who travel often. On the other hand, usage of the traditional check has declined rapidly over the time. Not only the check but also the cash transactions have been declining in recent years. Meaning future or the latest trend in payments are becoming completely digital.

Next level of digitalization of the payment industry is the mobile wallets, blockchain and crypto currencies. Digital wallets have become more popular over the customers as these payments are contactless, convenient and fast. Many predict that mobile wallets will soon overcome physical card payments in the near future. Apple Pay, Google Pay and Ali Pay are already well used by many around the world.

Cryptocurrency & Decentralized Currency

Cryptocurrency is a decentralized digital currency which has no control by any governments or institutions. The technology behind the crypto currencies is called the block chain. It is a large network that is capable of keeping huge amounts of records that can securely validate the transfer of cryptocurrencies.

Crypto currencies such as Bitcoins are becoming very popular due to their speed and security. Still these crypto’s are not widely accepted as people are still getting used to them. But once the crypto currencies become one of the main methods of payments once again the payment industry will be lifted up to a whole new level.

Why are these cryptocurrencies so important in the payment industry? As the world is getting globalized at an increasing speed, the need for a decentralized system for payment is becoming more each day. Block chains and crypto currencies have been introduced in 2008 and since then people have started accepting the new concept of payment with a rapid move towards it.

There are around 12,000 crypto currencies at present and new coins keep getting added to the list every day. Right now people use crypto currencies as investment opportunities. Acceptance of crypto for regular transactions still remains limited. It may become the easiest and safest payment method in future once more merchants start accepting crypto as a payment.

To compete with various kinds of block chains and crypto the governments are looking into issuing digital currencies from their central banks and these digital currencies can tie to a country’s existing physical money. Central Bank Digital Currencies (CBDC’s) will be an easy and trustworthy way of making transactions to any part of the world.

Credit products have also become one of the widely used products in international money transfers in recent years. Payment schemes like buy now pay later have also catched many customers’ interest. Payments & remittances industry is vital for all the nations for their economies to grow. As people are becoming more mobile they need quick, safe, easy and less costly ways to transfer money both locally and internationally.

To cater to these needs, the payments & remittances industry has rapidly changed mainly by adopting the latest technology to provide a better service and a range of products to choose from to perform a transaction according to an individual requirement. Remittances are becoming more transparent and accessible with the use of the latest technology such as block chains.

It is no doubt clear that the future of payments will be completely turning towards digitalization and not only private service providers but governmental financial institutions and banks are also turning their traditional practices into more efficient digitalized methods.