Cross border payments became more essential in this current generation due to the advancements in modern technology which paved the way for international transactions and enabled us to travel across international borders. International exchanges play a significant role in the growth of the country’s economy. To know its importance and contribution to the country’s growth you must know about Balance- of -payment accounting.

Accounting for balance of payments maintains and organizes the records of cross-border transactions. To manage cross-border transactions between various nations, the balance-of-payment account uses two separate types of accounts: current accounts and capital accounts.

Current Account

The merchandise balance is managed by the current account, which means that only the trade in goods is managed. Services like shipping and civil aviation, travel, government outlays (including military) by the domestic government and outlays by foreign governments domestically, interest and profit and dividend distributions from investments, insurance payments, earnings from banking, merchanting, brokerage, telecommunications, and postal services, movies and television, royalties due by branches, subsidiaries, and associated businesses, and the money and transactions associated with the services will all be included.

Capital account

The long-term and short-term costs incurred across international borders are managed through the capital account. The exchanges involve the import and export of products, the provision of services, the payment of remittances, and the provision of foreign aid.

Long-Term flows

Long-term capital movement is classified into direct investment and portfolio investments. The UK had the major contribution to direct investment overseas. The important direct investments between the countries fall on railways and other fundamental installations. Initially, direct investments helped developing countries balance their payments. Later, the flow of interest and profit raised the treasure of the investing country. UK’s overseas investment majorly contributed to the growth of developing countries like Sri Lanka. Its rapidly growing population and small cultivable land permitted large net import of food and to manage corresponding deficits in merchandise accounts. The complementary surplus supported this developing country to pay the interest and profit to the investing countries.

Short-Term flows

Investments in the country’s industrial and commercial development are shown in short-term flows. The long-term investment in the business, which is repaid over a lengthy period of time in regular installments, is also included in the short-term payment. The expectation of changes in exchange rates drives short-term capital flow. These short-term flows, which do not directly include foreign exchange transactions, deal with the movement across national borders. Instead, they indirectly participate in causing foreign exchange transactions.

International exchange services provide benefits to the public on a larger scale by enabling users to conduct international transactions without worrying about financial regulations and easing the hassle associated with managing the regulations in balancing the currency value during international transactions.

Cross Border Payments – International Wire Transfer vs. Global ACH

While the demand for international exchange surges, banks and other external organizations entered the verge to serve its magnificence with utmost efficiency. There are two methods for sending money across international borders between bank accounts. a money direct deposit through a local bank network or an international wire transfer (also called global ACH). Despite the fact that both tactics have the same objectives, every remittance and payment method has different conditions and ramifications.

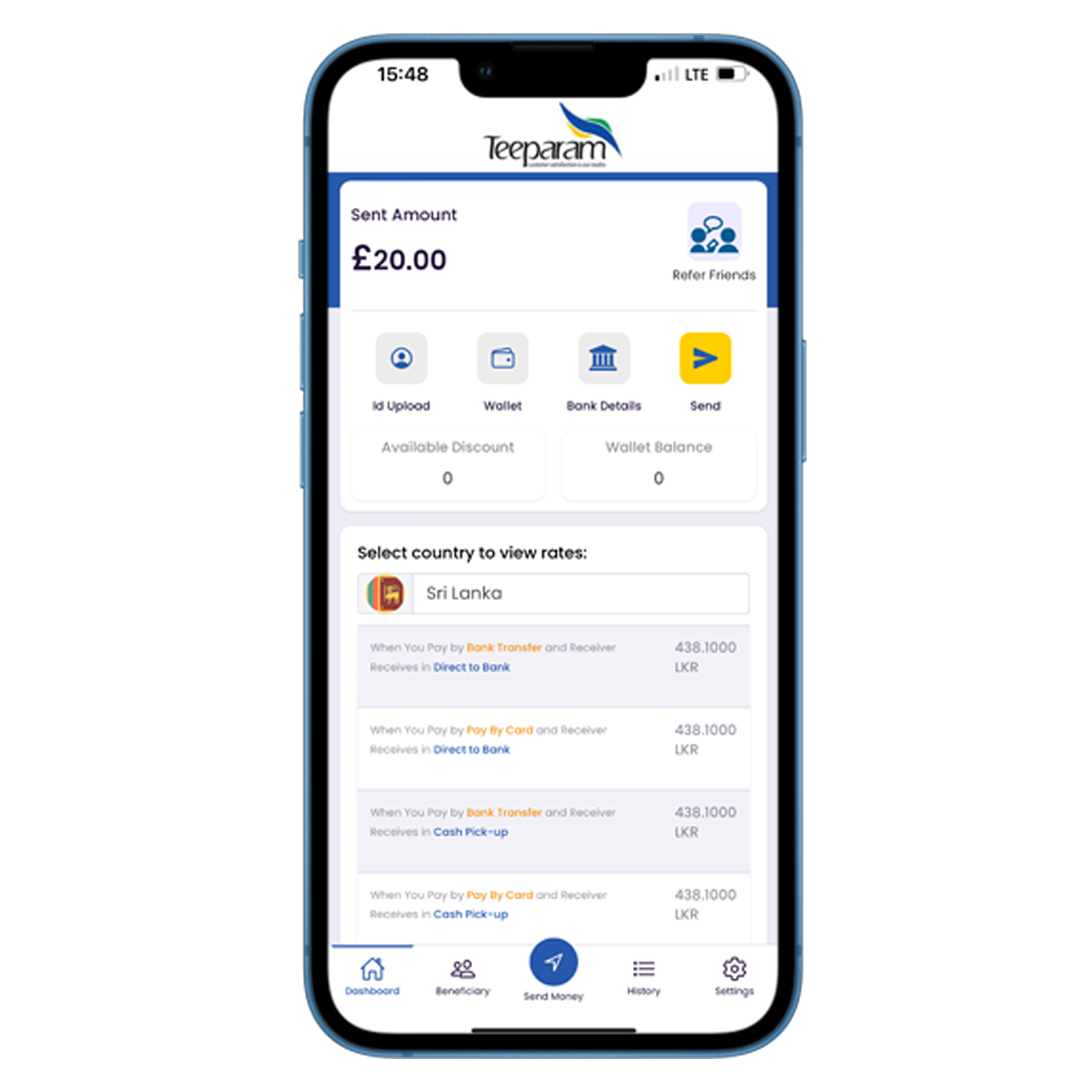

There are also private online money transfer service providers who assist in making international exchanges more efficient in terms of transaction charges and duration in executing transactions along with more exciting features. To analyze the best services to engage with, in making international exchange can be evaluated by considering these factors. We are also offering best exchange rates to Sri Lanka,

1. Speed

Wire transfers are one of the main services used by conventional systems to conduct cross-border transactions. The typical delivery time for money sent in this fashion is about two business days. This is due to the fact that you are transferring funds straight from your account to the recipient’s account at the receiving bank.

The transaction is quicker because the banks are constantly in close contact with one another. To complete the transfer, you will nevertheless require account details like the SWIFT code or IBAN (International Bank Account Number) of the foreign bank.

Depending on the involved nations and currencies, the international wire transfer’s speed can change. Standards and laws fluctuate depending on the location. An international wire transfer typically takes 2 to 4 business days to reach the recipient bank.

Compared to an international wire transfer, a worldwide ACH frequently requires an additional 2 working days. The cutoff hours for outgoing wire transfers vary depending on the bank and time zone of the originating bank. A global ACH makes use of the recipient bank’s clearing network rather than two banks exchanging messages.

When using the direct deposit option, money transfers are always processed in batches or groups with other transactions that use bank transfers. This causes the process to take longer than expected—from a few hours to a few days. Online money transfer services lead in these cross border transaction services by providing the most advanced ecosystem to make your transactions more efficiently compared to these banks and wire transfers.

2.Transaction Fees

As previously said, it’s critical to take fees into account when sending money abroad. There may be significant charges for international wire transfers. Sending money can cost up to $50, while receiving it can cost up to $10. There are always additional charges associated with currency exchange. Any business moving money abroad may be surprised by this since it is typically not discussed.

On the other hand, transaction costs for local or international bank transfers can be extremely low. In contrast to an international wire transfer, some are actually as low as $5. When a business wants to conduct sporadic cross-border transfers, the processing costs might pile up even if larger financial institutions and banks can be the apparent choice for security.

Banks may impose costs based on the sort of money you transmit, despite the fact that internet banking will cut out some processes. For instance, Bank of America will charge $35 and $45 respectively for outgoing international wire transfers sent in different currencies.

These sums also do not include foreign exchange commissions. Furthermore, international wire transfers always arrive ahead of those sent in U.S. dollars. This seems a little odd. Online money transaction service providers like Teeparam exchange charges less compared to these wire transfer services which is achieved through its widespread network across the globe.

3. Regulations and Limitations

The volume and frequency of the transactions are two more factors to take into account when deciding whether to use a local bank transfer or an international wire transfer. The minimum and maximum amounts you can send at each financial institution, as well as the frequency restrictions, are different.

If you transmit large sums or transfers frequently, this is a “make it or break it” point. Your bottom line will be impacted by all of this. Log onto your online banking application or contact a corporate representative if you are unsure of how your bank charges. Don’t enter the transfer in the dark.

When all of this is taken into account, using an online money transfer service is the most affordable option to send money abroad. Foreign Assets Control has established criteria that financial institutions managing your foreign transfer must adhere to (OFAC). Based on U.S. foreign policy, the agency regulates the economic and trade sections against particular foreign nations, banks, and people. To make sure the transaction conforms with all OFAC regulations, all banks are required to screen all international ACH transfers.

Additionally, in order to complete an international money transfer, occasionally additional sophisticated data is needed as part of your compliance, regulatory, and screening processes. You might ask for things like identification and bank information.

Teeparam exchange satisfies all the above mentioned factors by offering the most advanced international money transfer services in a secured ecosystem with low transaction fees. Its top-notch security protocols enables processing bulk transactions across international borders more effectively without any failures. As finance is one of the prominent sectors that elevates the lives of an individuals and a country’s economy , Fintech companies are enlarging its global services in making financial operations more effectively. While the neural system of the country is handled by the fintech companies, it is mandatory to follow the ethics and regulations to ensure offering the most secure and effective fintech services.