Digital payments have been serving the nation in multiple ways. It supported building the pillars of the nations by enabling financial sectors to support the people exceptionally and serve the nation. These advancements in digital payments supported businesses to attain tremendous growth and establish themselves in various parts of the world. This astonishing growth and development in society support the growth of the nations with multiple streams of revenue sources. One of the prominent revenue sources that fuels the nation’s growth is its remittance fees.

This remittance fees are collected from every international transaction. The advancements in modern technology and infrastructure development supported us to travel and trade across different parts of the world and build strong relationships among nations and work towards developing a better future. Many nations support the growth of technology and support the growth and development of multiple benefits as it gets benefited from the same. This ability to build relationship with multiple nations across the globe via trade, travel and business made nations to experience enormous international transactions and the remittance fees begun flooding the nations for its growth and development.

Importance of Remittance Services and Digital Payments

Eighty percent of the population of the city is made up of immigrants who left their home country in search of employment or business opportunities. Cities are created by industry, and as a result, their infrastructure must grow to accommodate the import and export of goods. Cities progressively developed from the locations that served as a hub for the production and trade of products. Due to the lack of technical breakthroughs at the time, the industries and industrial facilities required a significant amount of labor.

Since so many individuals moved to the city in search of employment, many companies and retail establishments also grew there to cater to the local populace. The same holds true on a large scale, causing people to relocate from their home country to other industrialized nations that offer satisfying jobs and business opportunity and comfortable life with a better income that supports them to take care of their family who lives in their homeland. This relationship between a developed country and the underdeveloped country is purely reflected in the relationship between the UK and Sri Lanka.

Over 3 million Sri Lankans who reside overseas send money to their homeland to help friends, family, and others back home. Everyone needs a simple and affordable way to transfer rupees. Through this the nation handles millions of transactions each month.

Remittances of foreign currency are essential to the nation’s ability to meet its basic needs. Remittance services, which have historically provided the majority of Sri Lanka’s income, are a necessity. The majority of the funds are sent each month to friends and family members in Sri Lanka by migrant workers. These overseas workers assisted the nation in 2013 by reducing the trade deficit and raising foreign reserves. A nation’s growth is heavily dependent on remittances since they are less variable than foreign direct investments and government development assistance.

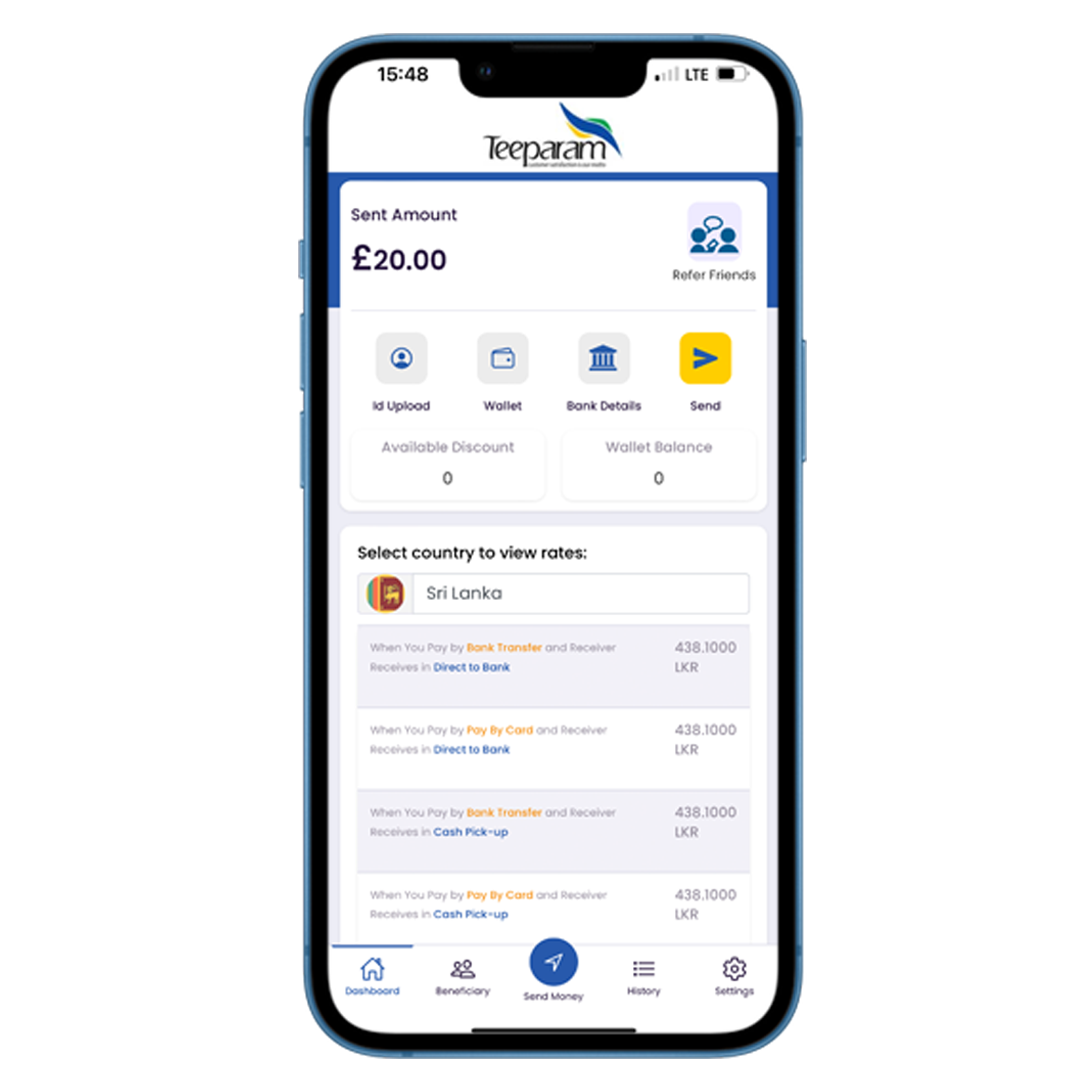

Sri Lanka has therefore planned to provide incentives for remittances as it struggles to keep track of foreign currency. This makes it simple for consumers to send money to Sri Lanka. Teeparam Exchange is a cutting-edge ecosystem that provides a wealth of features to facilitate international trade while ignoring the difficulty in sending money across international borders. And user will be getting the best rates in the market while he/she send money to Sri Lanka. Users can check our daily rates on website and Social Media page.

Contribution of Money Transfer to a Nation’s Economy

Transferring money across international borders from one nation to another is known as international exchange. For individuals who need to make such payments, there is a market where such foreign nations are bought and traded. Such payments may be made by nations to cover capital expenditures, trade debts, or other obligations. Additionally, importers, exporters, multinational organizations, and people who transacted business internationally with friends and family who resided abroad also conducted these transactions. These overseas transactions significantly boost a nation’s GDP.

Money transfers from one country to another do not end this process. Each country will have its own currency, rules, and value, which may be interrupted by international boundaries when converting from one currency to another to balance out the value of each nation’s economy. Countries with centralized economic planning, such as China, prohibit private providers of foreign exchange services, have complete control of all international transactions, and establish a monopoly on overseas trade. To get a deeper understanding of the international exchanges and the process beneath them, one must know about the Balance- of -payment accounting.

Balance-of-payment accounting holds and manages the records of the international transactions between different countries. The balance-of-payment account uses two types of accounts, current accounts, and capital accounts, to manage international transactions between different countries.

Current Account

The merchandise balance is managed by the current account, which means that only the trade in goods is managed. Services like shipping and civil aviation, travel, government outlays (including military) by the domestic government and outlays by foreign governments domestically, interest and profit and dividend distributions from investments, insurance payments, earnings from banking, merchanting, brokerage, telecommunications, and postal services, movies and television, royalties due by branches, subsidiaries, and associated businesses, and the money and transactions associated with the services will all be included.

Capital Account

The long-term and short-term costs incurred across international borders are managed through the capital account. The exchanges involve the import and export of products, the provision of services, the payment of remittances, and the provision of foreign aid.

Apart from Sri Lanka, there are many nations that gets benefited enormously from the remittance fee. This is achieved by the strong relationship between developed nations and developing nations which share manpower and services for the wellness of each other. Teeparam facilitates exceptional services to make this relationship stronger by frequently making international transactions across many nations more efficiently with less transaction fees.

Teeparam exchange offers the most advanced money transfer services with defense grade security and provides exceptional convenience to the user in making international exchanges with very simple steps. Teeparam exchange also offers its services through mobile apps which are platform independent that are capable of performing its services in both Android and iOS devices. Download Teeparam mobile app experience exceptional benefits offered by Teeparam in making international money transfers.

Read our other blog on why international money transfers preferred over bank transfers.