Currency exchange rates have impacts on all sorts of people around the world. Whether you are traveling, shopping online, sending money abroad, or investing, currency exchange rates can influence your finances. Understanding exchange rates is important. But how do they work? Let’s find out.

What Is an Currency Exchange Rates?

An exchange rate lets you know how much of one currency you can get in exchange for another. For example, if you want to convert British pounds (GBP) into euros (EUR), the exchange rate will determine how many euros you receive for each pound.

Exchange rates can also work in the opposite direction. If you want to convert euros back to pounds, the rate will tell you how many pounds you get for each euro.

How to Calculate an Exchange Rate Conversion

To find out how much money you’ll get when exchanging currencies, all you need to do is multiply the amount you have by the exchange rate.

Example: You want to exchange £500 for euros.

- If the GBP/EUR exchange rate is 1.10, you will get:

500 x 1.10 = €550

Why Do People Exchange Currencies?

People and businesses exchange money for many reasons, including:

- Traveling: If you visit another country, you need to exchange your money for their local currency.

- Shopping from other countries: If you buy something online from another country, you might need to pay in their currency.

- Sending money abroad: If you send money to family or friends in another country, it will need to be converted.

- Investing: Investors might buy and sell foreign currencies to make a profit.

- International business: Companies trading with other countries must convert money for goods and services.

Factors that Makes Exchange Rates Go Up or Down?

Exchange rates can fluctuate at any given time. Sometimes they go up, and sometimes they go down. But what causes these changes? Here are some key factors:

- Inflation and Exchange Rates

Inflation leads to a rise in commodity prices. A little inflation may go unnoticed, but too much can cause a currency to lose its value. When inflation is high, people might need more of that currency to buy the same things. This can lower the currency’s value in exchange markets.

Central banks, like the Bank of England or the Federal Reserve in the U.S., try to control inflation by adjusting interest rates

- Interest Rates and Exchange Rates

Central Banks set Interest rates mainly to control inflation and borrowing. When interest rates go up, people earn more from saving money in that country. This attracts foreign investors who want to save their money where they get the most profit. More demand for that currency increases its value.

For example:

- If the U.K. raises interest rates, more people may want to invest in British banks, increasing the demand for GBP and making the pound stronger.

- If interest rates fall, investors may move their money elsewhere, decreasing the demand for GBP and making it weaker.

- International Trade and Exchange Rates

Countries that have more exports than they import usually have stronger currencies. This is because other countries need their currency to buy goods from them.

- A country with a trade surplus (selling more goods than it buys) will have a strong currency.

- A country with a trade deficit (buying more goods than it sells) will have a weaker currency because it needs to exchange more of its money to pay for imports.

- Market Expectations and Exchange Rates

Both traders and investors also influence exchange rates based on what they think will happen in the future. If they believe a country’s economy will improve, they may buy that currency, increasing its value. If they expect instability, they may sell the currency, lowering its value.

For example:

- If investors think the U.S. economy will grow fast, they might buy U.S. dollars (USD), making the dollar stronger.

- If they think a country’s economy is slowing down, they may sell that currency, making it weaker.

- Political and Economic Stability

Countries with political stability and strong economies tend to have stronger currencies. If a country has political unrest, war, or a financial crisis, people may avoid using its currency, causing it to lose value.

For example:

- If a country is experiencing political turmoil, investors may move their money to a more stable currency like the U.S. dollar.

- If a country has a growing economy and stable leadership, its currency may strengthen.

How to Get the Best Currency Exchange Rate

If you are looking to exchange some money, here are some tips to get the best rate:

- Compare rates: Check different exchange providers, such as banks, currency exchange services, or online platforms.

- Avoid airport exchanges: Exchange rates at airports are usually worse than those at banks or online services.

- Use online tools: Websites and apps show live exchange rates, helping you know when to exchange your money.

- Consider bank fees: Some banks charge hidden fees on currency exchanges. Always check the total cost.

- Use a multi-currency account: Some banks offer accounts that let you hold different currencies and exchange them at better rates.

The Role of Central Banks

Central banks play a crucial role in controlling exchange rates. They do this by:

- Adjusting interest rates to control inflation and borrowing.

- Buying or selling currencies to increase or decrease their value.

- Setting policies that affect how money moves in and out of the country.

For example, the European Central Bank (ECB) and the Bank of England make decisions that impact how the euro and the British pound perform against each other.

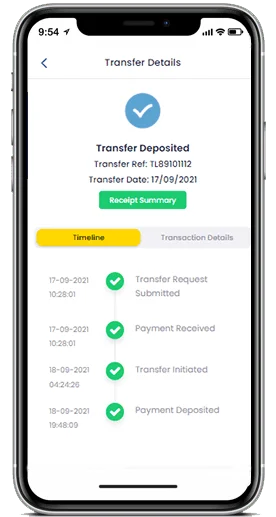

Exchange rates can have a great impact on daily life, from travel to shopping and investing. By understanding how they work, you can make better financial decisions. For all your money transfers and exchange needs look no further contact Teeparam Money Exchange. They offer fast, secure, and convenient solutions to send money abroad. With a fast and easy online process, competitive exchange rates, and low fees, Teeparam ensures hassle-free international transfers. Trusted by many, Teeparam provides reliable and efficient money transfer services, making it the ideal choice for send money to Sri Lanka and other foreign countries like India, Australia, Malaysia, Canada, USA, Switzerland, European countries.