Exchange rates are the most watched economical changes that makes the global economy to revolve by defining its growth and financial abilities. A country’s economy and its growth is defined by its currency value and exchange rates. A country’s imports and export ratio, trade volume, financial contribution and performance in the global market decides the value of the country’s currency and its exchange rates. Higher exchange rates give a negative impact for a country which will reflect in the cheaper exports and expensive imports, lower exchange rates give a positive impact by facilitating costlier exports and cheaper imports of foreign goods.

A nation’s currency value and its usage impacts the global economy and supports availing goods for cheaper price in comparison to the other nations. The volume of imports and exports and trade frequency decides the value of the currency and this difference in the trade volume creates the difference in the currency value between the global nations. Exchange rates are the decision makers of the global economy through which the value of the commodity, golds, stock and asset value is decided whereas the financial value and the growth of the country is dependent and the global investment will be made upon the changes in the exchange rates.

While these exchange rates play a vital role in the global economy , it is mandatory for any individual to know about how an exchange rate contributes to the global economy and know about the factors that affect the currency rate and its differences from one country to another. There are few major factors that fluctuate the economy of a country and affect the exchange rates remarkably. This blog digs out the top factors that affect the exchange rates and gives a better understanding about the exchange rates and the components that contribute to the changes in the exchange rates. This blog will give you a clear understanding on the factors deciding exchange rates.

Inflation : Major factor behind Exchange Rates

Inflation is one of the curious factors that manipulates the exchange rates with huge differences. Inflation in a country leads to an increase in the value of goods and at the same time, it reduces the value of the currency too. This makes the currency rates highly fluctuate and experiences a serious drop in its value.

Deflation is directly opposite to inflation which reduces the price of goods and increases the value of currency in the global market. This builds the strength for currency value and increases its exchange rates. Many countries like Sri lanka , Britain are experiencing a serious financial crisis and its inflation rate is experiencing its all time high.This makes its exchange rates to fall deeper which causes a serious downfall for the nations currency value and impacts its exchange rates globally.

Interest Rates

Interest is directly in correlation with inflation which also reflects its effects in exchange rates.Central banks can influence the interest and inflation and contribute to the changes in the exchange rates.Central banks play a huge role in managing the financial stability and stable inflation among the global nations. Central banks perform actively with their financial tools and abilities when the global nations experience an incorrigible financial crisis.

These central banks also take part in the raise in interest rates which also benefits the lenders exceptional in making huge returns. This eventually increases the exchange rates and also supports gaining strength over your currency in the global economy and attracts foreign capitals, thus increasing exchange rates.

Recession

Recession is evolving as a drastic nightmare that many countries are experiencing now followed by economic depression caused by this global pandemic. In recession people will lose their purchasing power, even if the goods are available for low cost, people will not be able to afford the goods due to the loss of jobs and poor employment opportunities. This is also one of the serious factors that affects the exchange rates.

Balance-of payment

A country’s financial status can be defined by the result of the current account which reflects the balance-of trade and earnings on foreign investments. This earning comprises the total number of transactions including imports, exports and debts.

A deficit in the current account affects the export of goods and increases the imports which will eventually reduce the strength of the currency and it reflects in the drop in exchange rates .

Government Debts

Government Debts are the debt owned by the central government from different nations for the development of the country. Higher debts decreases the value of exchange rates over the nation’s currency. This factor also affects the interest from foreign countries to invest in a country which eventually results in inflation.

Term of Trades

Terms of trades is another crucial factor that decides the exchange rates of currency and growth of the country’s economy. Higher exports from the country will support the growth of the country’s economy and increase its exchange rates. Increase in trade volume will show the demand for a country’s exports in the market.

Demand for the country’s goods will increase the frequency of foreign investments and also increase the exchange rates. If the import ratio of the country exceeds its export ratio, then the country will lose its financial value in the global markets and the foreign countries will hardly show interest in the country for investment.

While there are numerous factors pertaining in the market to influence the exchange rates, one must know about the importance of exchange rates while making international exchanges. Money transfer across international borders became essential with the ability to connect with others across the planet and travel anywhere around the clock.

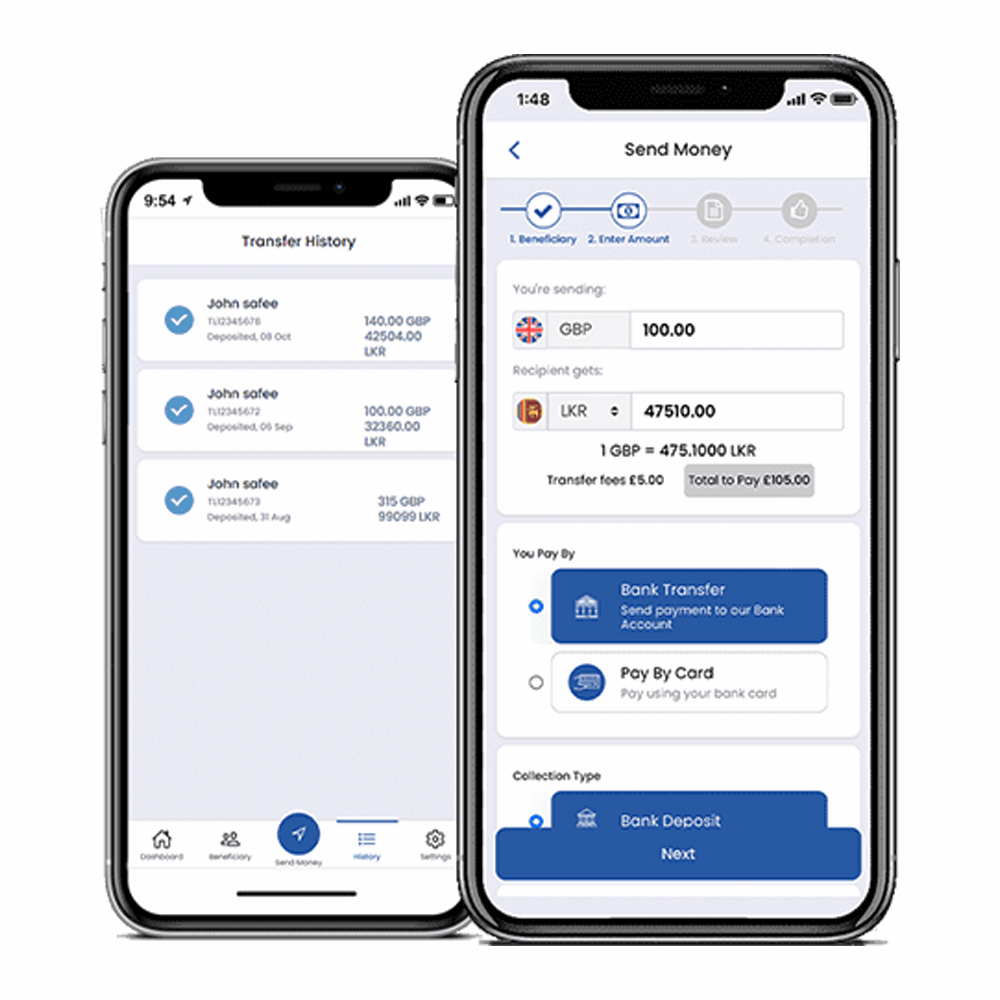

While dealing with such influential traits one must be aware of the market performance and currency value before exchanging it to one another. Explore the power of economy by making international exchanges more efficiently with Teeparam which assist you in sending money across international borders more effectively with live market rates that supports in send money to Sri Lanka, India, Canada, European Countries and many foreign countries at best exchange rates available in the market.

You can check our daily exchange rates for the list of countries we offer services either from our website or through our social media posts. For more info on our sri lanka exchange rates, please read our blog titled Send Money to Sri Lanka: Game Changing Speed and Transfer Fee