The currency exchange market, also known as the foreign exchange market or forex market, is a decentralized global financial market where participants can buy, sell, exchange, and speculate on currencies. It is the largest and most liquid financial market in the world, with an average daily trading volume of trillions of dollars.

The primary participants in the currency exchange market are banks, financial institutions, governments, corporations, and individual traders. They engage in currency trading to facilitate international trade, investment, tourism, and other cross-border transactions.

What is an example of an Currency Exchange rate?

For example, when a company from one country (India) wants to import goods from another country (USA), it would need to exchange its local currency for the currency of the country from which it is importing. Meaning India needs to convert their Indian rupees (INR) to USA Dollars (USD).

Why the exchange rate is important to us?

Now have you ever wonder why it is important for you and me to know about currency exchange market? The currency exchange market, is a crucial financial platform for individuals worldwide. Firstly, it enables international travelers to exchange their home currency for the local currency of their destination country, facilitating smooth transactions during their trips.

Additionally, for individuals involved in international trade, the market allows them to convert their earnings or payments into their home currency or that of their trading partners. Moreover, the forex market presents investment opportunities for individuals interested in trading foreign currencies, allowing them to potentially profit from exchange rate fluctuations.

Furthermore, those seeking to invest in foreign assets, such as stocks or real estate, rely on the currency exchange market to convert their funds into the appropriate currency.

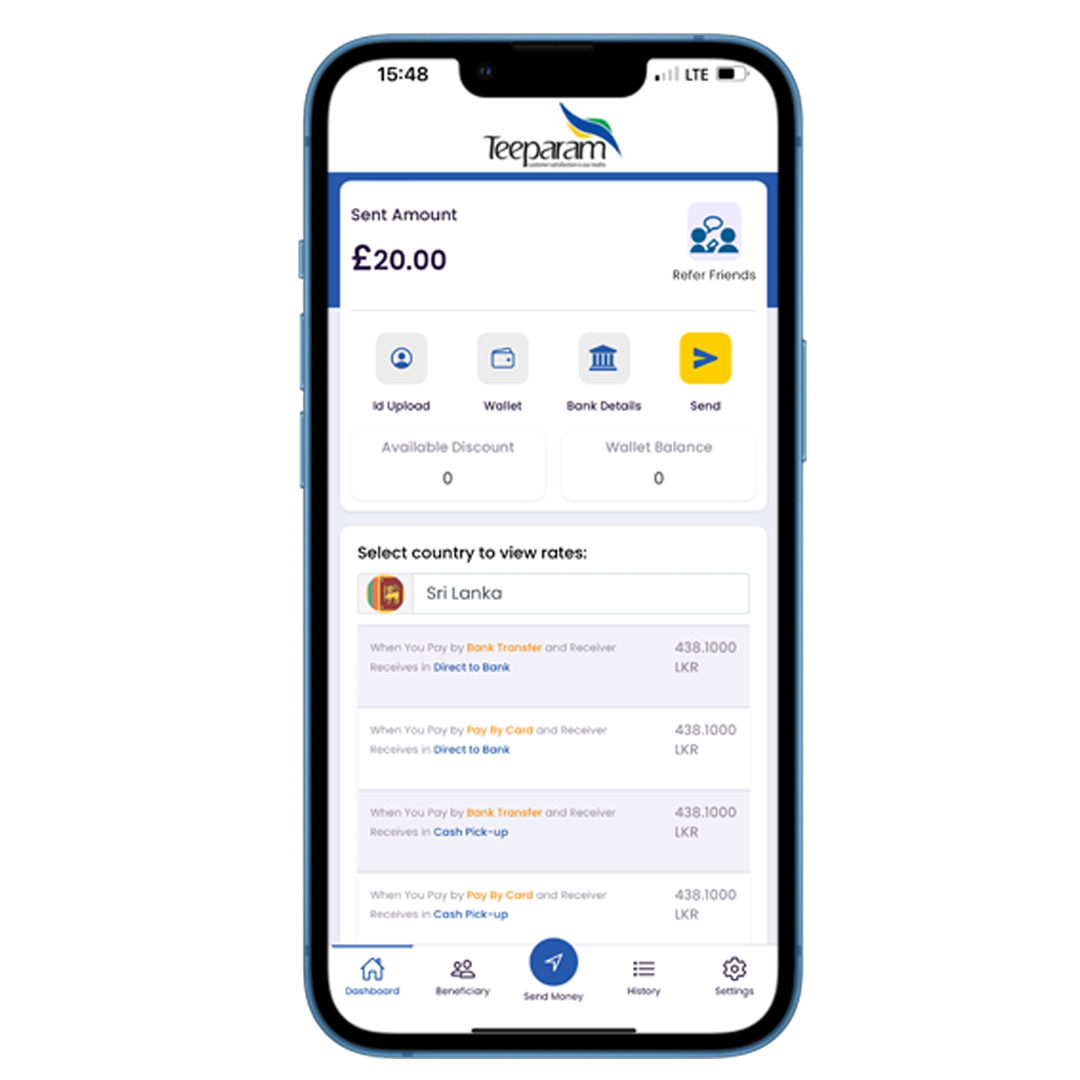

Additionally, it supports individuals working abroad who send money back home by converting their earnings into their home currency for remittances. For risk management purposes, individuals and businesses use the market to hedge against currency fluctuations through financial instruments like futures and options.

Moreover, currency exchange rates can serve as economic indicators, providing insights into a country’s economic health and guiding travel plans or financial decisions. While the currency exchange market offers diverse benefits, individuals must be cautious of the inherent risks associated with currency trading and seek professional advice when needed.

Does Currency Exchange Rate have an impact on the economy?

Exchange rates have significant impacts on the economy of a country, influencing various economic factors in both positive and negative ways. One of the key impacts is on export and import competitiveness.

Exchange rates also play a crucial role in inflation. They influence the cost of imported goods and services. A depreciated currency can lead to higher import prices, contributing to inflationary pressures in the domestic economy. On the other hand, an appreciated currency can help lower inflation by reducing the cost of imports.

Exchange rates impact a country’s foreign debt and borrowing costs. Additionally, exchange rates influence foreign direct investment (FDI) and capital flows. Exchange rates play a role in a country’s balance of payments, which is the record of all economic transactions between residents of the country and the rest of the world.

A strong currency can lead to a trade deficit, as imports become cheaper, while a weak currency may lead to a trade surplus. Exchange rates also affect the tourism industry. They influence the cost of international travel, affecting tourism revenues and expenditures. A weaker currency can attract more foreign tourists, benefiting the tourism sector, while a stronger currency may deter domestic tourists from traveling abroad.

Overall, exchange rates are a critical determinant of a country’s economic health and competitiveness in the global market. Governments and policymakers closely monitor and manage exchange rate movements to support their economic objectives and maintain stability in their economies. The interplay between exchange rates and various economic factors underscores the importance of a well-balanced and strategic approach to managing currency values to ensure sustainable economic growth and stability.

What are the factors that affect the currency exchange market?

Several major factors influence the currency exchange market and cause fluctuations in exchange rates. These factors can be economic, political, or related to market sentiment. Our sri lanka exchange rate from UK is the best at low remittance charges.

Interest Rates: Central banks’ decisions on interest rates significantly impact currency values. Higher interest rates in a country tend to attract foreign investors seeking better returns, leading to increased demand for that country’s currency and appreciation of its exchange rate.

Economic Indicators: Economic data such as GDP growth, employment numbers, inflation rates, and trade balances influence currency exchange rates. Strong economic performance is often associated with a stronger currency, as it signals a healthy and attractive economy to foreign investors.

Political Stability and Economic Policies: A country’s political stability and the effectiveness of its economic policies play a crucial role in determining its currency’s value. Stable political environments and sound economic policies generally attract foreign investment and support a stronger currency.

Geopolitical Events: Political developments and geopolitical tensions can create uncertainty and impact currency markets. Events like elections, trade disputes, wars, and diplomatic issues can lead to volatile currency movements.

Market Sentiment and Speculation: Market participants’ perceptions and expectations can drive short-term currency movements. Speculators and investors often react to news and sentiment, leading to fluctuations in exchange rates.

Trade Balance: A country’s trade balance, which represents the difference between its exports and imports, affects its currency exchange rate. Countries with trade surpluses generally experience currency appreciation due to higher demand for their exports.

Capital Flows: The flow of capital in and out of a country also influences its currency value. Strong foreign investment and capital inflows can lead to currency appreciation, while capital outflows may lead to depreciation.

Central Bank Interventions: Some central banks intervene in the currency market to stabilize their currencies or achieve certain economic objectives. Large-scale interventions can influence exchange rates.

Market Liquidity and Volume: The currency exchange market is highly liquid and large volumes of trades occur daily. Low liquidity periods, such as holidays or market disruptions, can lead to increased volatility.

Natural Disasters and Global Events: Natural disasters, pandemics, and global events (like the COVID-19 pandemic) can disrupt economies and financial markets, leading to currency fluctuations.

Hope you liked our blog on factors which affect currency exchange market. For more info on our services please head over the website of Teeparam.