Foreign currency exchange market also known as forex or FX is an over-the-counter (OTC) global marketplace that determines the exchange rate for global currencies. Participants in these markets can buy, sell, exchange, and speculate on the relative exchange rates of various currency pais. It is one of the largest financial markets in the world and comprises a global network of financial centers that transact around the clock, closing only on the weekends.

Foreign currency exchange markets consist of banks, forex dealers, commercial companies, central banks, investment management firms, hedge funds, retail forex dealers and investors. Forex enables buying, selling, exchanging and speculation of currencies and also a platform for currency conversion for international trade, settlement and investments.

Little bit of history

Ancient civilizations were trading goods and services and later they started trading the coins. This was the basement for the current forex market. The very first forex market was in Amsterdam around 500 years ago. It allowed people to freely trade currencies to stabilize exchange rates.

Once the gold standard was introduced countries were only allowed to print currency equal to the amount of their gold reserves. There were 71 forex trading firms in London in 1913.

Later the Bretton Woods system was introduced and it enabled most currencies to be pegged to the U.S. dollar, which was backed by gold reserves.

Types of Foreign Exchange Markets

There are few types of foreign currency exchange market based on the type of product that is being used to trade FX including the spot market, the futures market, the forward market, the swap market, and the options market.

Spot Market

It is a market where the quickest transaction of currency occurs. It provides immediate payment to the buyers and the sellers according to the current exchange rate. From all the currency exchanges, the spot market accounts for almost one third and the trades usually take one to two days to settle the transactions.

Forward Market

There is two party involvement in the forward market, these parties can be either two companies, two individuals, or government nodal agencies. In this market, there is an agreement between two parties to do a trade at some future date, at a defined price and quantity.

Future Market

This market provides solutions to the problems that occur in the forward market and works similarly as the forward market.

Option Market

It is a market that allows you to buy or sell. Here an investor can

buy or sell an instrument that is underlying like a security, ETF, or even index at a determined price over a definite period of time.

Swap Market

Here two parties can exchange the cash flows or the liabilities from two different financial instruments. Most swaps involve these cash flows based on a principal amount.

What happens in the Foreign Currency Exchange Markets?

These exchanges facilitate currency conversions, manage foreign exchange risk, through futures and forwards, and for speculative investors to earn a profit on FX trading.

Functions of Foreign exchange market

Transfer Function: This is the most fundamental function of the foreign exchange market. It transfers the funds or the foreign currencies from one country to another for settling their payments. Basically it means the market converts one’s currency to another.

Credit Function: The foreign exchange markets also provide short-term credit to the importers to maintain a smooth flow of goods and services from different countries. The importers can use their own credit to finance foreign purchases.

Hedging Function: Another function of a foreign exchange market is to hedge the foreign exchange risks. The parties involved in the foreign exchange are often afraid of the fluctuations of the exchange rates. It is the price of one currency in terms of another currency and may result in a gain or loss to the party concerned.

Scope of Forex market

Foreign currency exchange market is vital to all the countries around the globe. It is a catalyst to society and for the global economy. Forex allows for currency conversions, facilitating global trade which include investments, the exchange of goods and services, and financial transactions. Major companies, governments and individuals need foreign exchange currency market for various needs.

Migrant workers

Many migrant workers need to send money back to their home countries for various reasons and they always need to convert one currency type to another. Likewise if you are working for a foreign company which pays you from their currency you always need to convert them back to your home country currency to spend within your country.

When converting a currency to another anyone would prefer getting the best conversion rate for their money. Some may wait for an extra time to get the best rate for their money.

Foreign students

Many students studying abroad receive money from their parents or guardians for their daily needs. They receive money most of the time to a bank account where their parents will be depositing from their own currency and when withdrawing it should be converted to the currency where the student is studying at present.

Central Banks

Central banks help take care of the exchange rate of the currency of their respective country to ensure that the fluctuations happen within the desired limit and it keeps control over the money supply in the market.

Commercial Banks

One way banks earn money is by converting foreign currency or by handling foreign currency transfers.

Government Departments

Tax departments earn most of their income by taxing from foreign currency exchanges.

International traders

Both imports and export based trade depends on foreign currency exchange or trading in foreign currencies. Also the businesses running out of their mother country need to deal with foreign exchange market.

Travelers

People travel frequently to other countries for various reasons like, business, studies, medical purposes and holiday making are few to mention. Whatever the reason is they all need to exchange their home currency into the currency they are visiting.

Forex Trading

If you are into forex trading or if you are a forex dealer you need currency conversions more frequently.

Investors

Investors who invest internationally deal more often with the forex market. Scope of foreign currency exchange market is diversified into almost every sector of the global economy. In other words the entire global economy is relying upon the foreign exchange market. It acts as the central hub to set prices for different currencies.

Investors largely depend on the Forex market to hedge or minimize the risk of losses due to adverse exchange rate changes. It also enhances international trade and overseas investments. And it is vital for the smooth flow of the banking sector.

The Foreign Exchange Market is the largest and the most liquid financial market in the whole world. With very few restrictions it allows the investors to invest in this market freely with minimal third party involvement. Many investors are not required to pay any commissions while entering the Foreign Exchange Market.

And it is open 24 hours, meaning no time restrictions. Forex market allows easy entry and exit to the investors whenever they feel unstable. The Foreign currency exchange market has become a pillar in each and every country’s economy as it is the only place that helps in determining the value of savings and is the hub where foreign money is bought and sold.

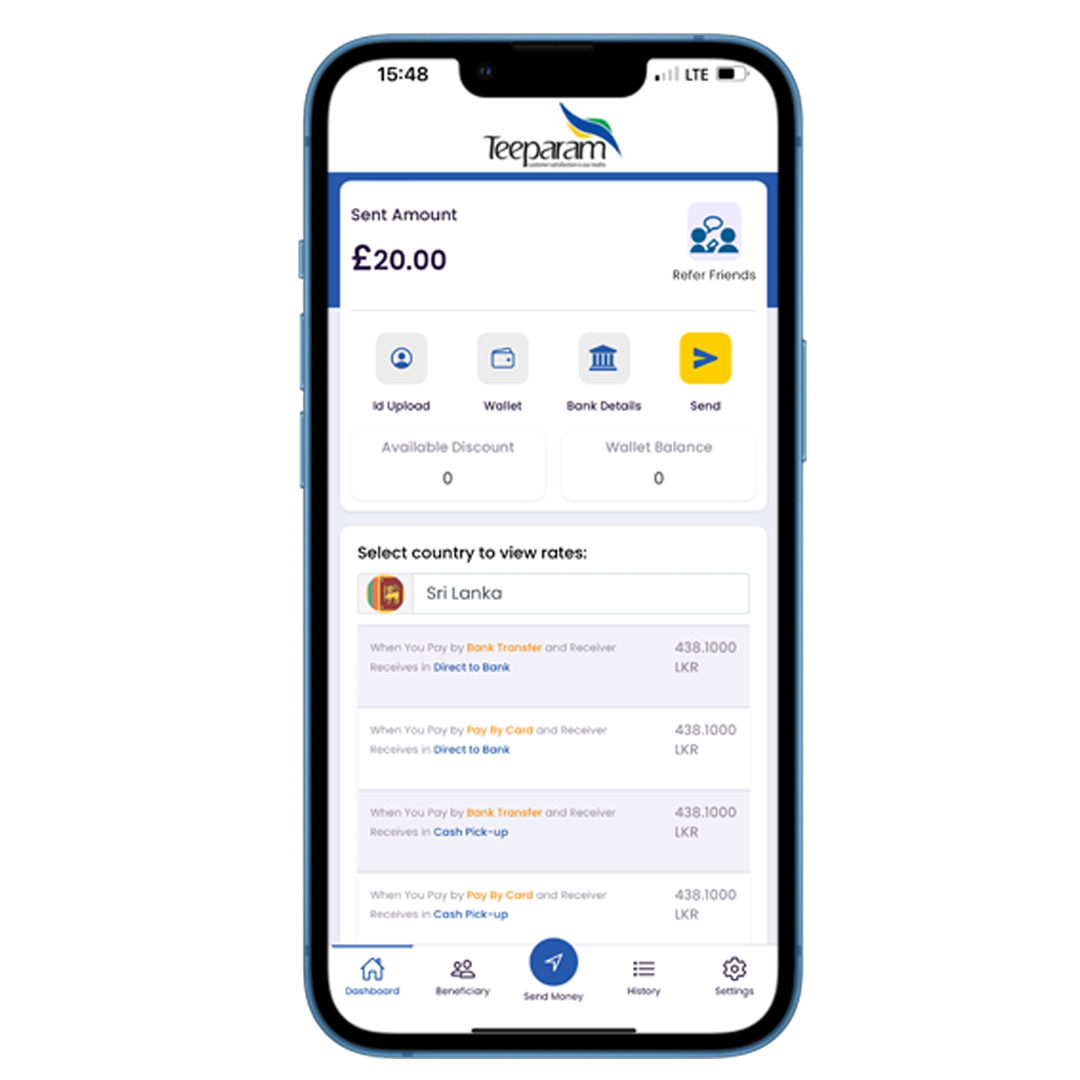

Hope our blog on currency exchange market was helpful. If you are looking to send money online, you can use Teeparam Exchange app which is available on both Android and iOS, our sri lanka exchange rate is the best in UK market.