Looking for an extra income or for avenues to multiply your earnings? Heard about making money through Forex trading? Still clueless how this has been done and thinks Forex Trading or FOREX is something exclusively for financial experts to make money. Truth is it is not as complicated as many of us think and anyone can become a pro trader by understanding the process step by step.

Before you get your hands into forex trading there are few things that you should understand as trading currencies are always risky and you should not invest more than you can afford to lose. But once you master the trading it becomes so much easier as most trading platforms are built with simplicity as their key. Today, the forex market is the largest and most liquid financial market in the world, with a daily turnover of $6.6 trillion. It operates 24 hours a day and comprises over 170 different currencies.

What is Forex trading?

Forex trading or currency trading or some call it FX trading is about trading currencies to make a loss or profit by closely speculating on the currency price fluctuations over a period of time. Forex trading is always done by a pair of currencies and traders will buy or sell one currency against another.

Either you gain or less depending on the price movement of that particular currency pair’s exchange rate. Forex trading is mostly done based on speculation and one needs to speculate whether the value of a currency, for example the GBP, will rise or fall in relation to another currency like the US dollar.

Exchange Rate

Exchange rate can be explained as how much value of your currency is in another currency. Every time an exchange rate is quoted, it is also stated in two currencies as a pair. To the ease of use each currency is quoted using an acronym for the national currency it represents.

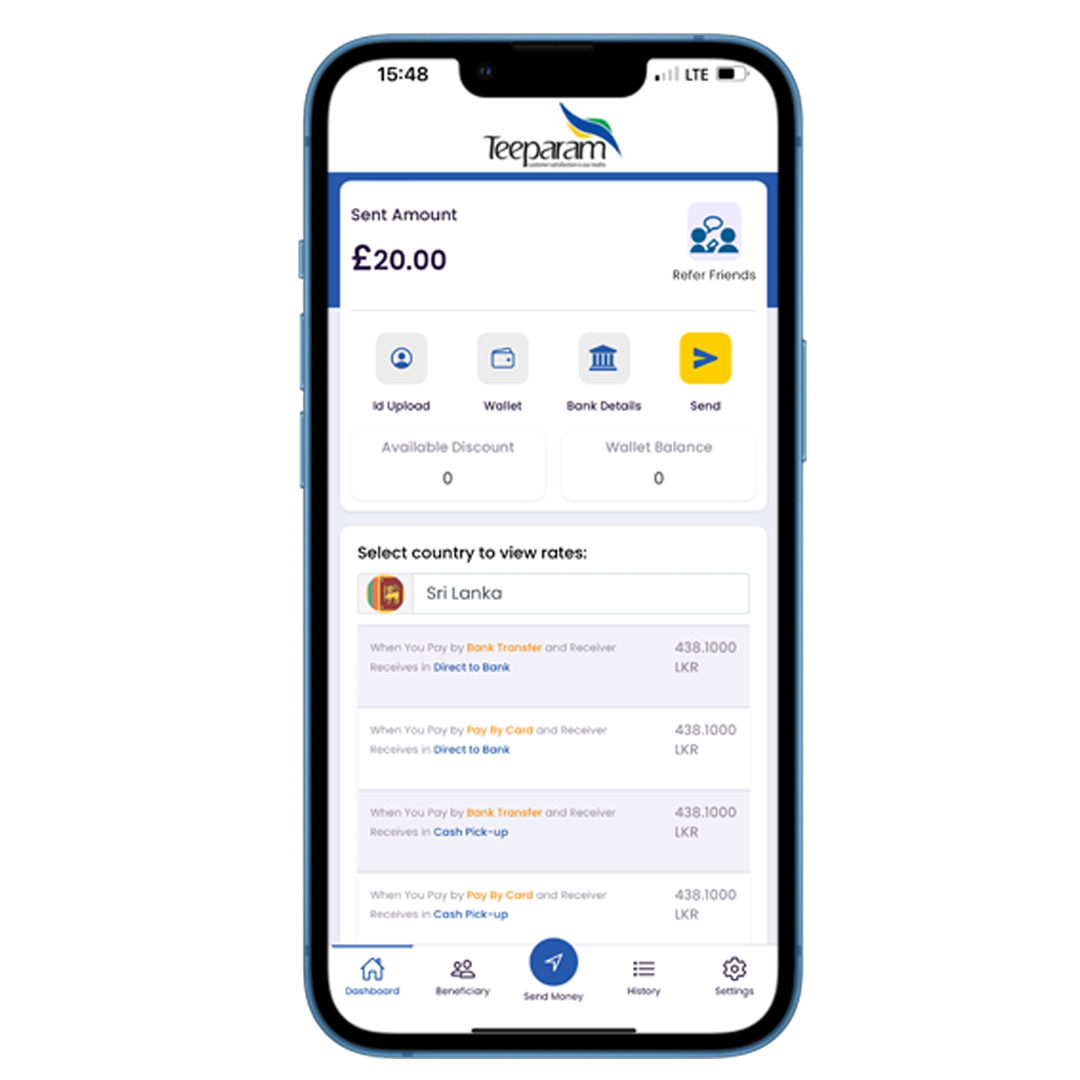

The United States Dollar acronym is ‘USD” and INR for Indian Rupee, GBP for Sterling Pounds, EUR for euro, JPY for Japanese Yen.etc. For example in Mar 2023, one Sterling pound (GBP) was equal to 1.20 United States Dollars (USD) , and 1 USD was equal to 0.83 Sterling Pounds. So exchange rate is set as GBP/USD = 1.20. And our Sri Lanka exchange rate from UK market is always the best with very competitive platform fees to send money to Sri Lanka from UK.

Forex Position

A position can be explained as the expression of a market commitment, or exposure, held by a trader. It is the financial term for a trade that is either currently able to incur a profit or a loss – known as an open position – or a trade that has recently been canceled, known as a closed position.

As mentioned earlier a forex position is always quoted in currency pairs. The first currency in the pair is called base currency and the second currency is called the quoted currency. Traders need to speculate on whether the base currency will improve in pricing or decline against the other quoted currency in the pair. To profit, you need to look at the fluctuations in the two currencies’ exchange rates.

First thing to do in trading is to pick a currency pair, say Sterling Pounds against US Dollars (USD/GBP). Once you open a trading position, you will be speculating on the direction in which the market is moving related to the pair you have picked. You can open either a buying position also called long position or selling position also called short position depending Price movements in the forex market that are affected by the strengthening and weakening of the currencies’ value.

Each currency pair has two prices. The first is the bid or sell price, while the second is the ask or buy price. The difference between the two quoted prices is the spread, which is your trading cost.

Upon your Speculation

If you speculate the base currency price will strengthen against the quote currency or the quote will decline versus the base, you buy the pair. If you speculate the base currency price will weaken against the quote or the quote will appreciate versus the base, you sell. Once you decide your position you place the order for a buy or sell depending on your speculation.

An order can be explained as an instruction to trade automatically at a future time when exchange rates meet a particular predetermined level set up by you. Stop-loss and limit orders are used to make sure that profits are locked in and losses are minimized.

Once you execute this buy or sell it’s been considered as an open position. When you are at an open position with the market price movement of your selected currency pair your profit or loss will fluctuate. You need to closely monitor this profit and loss, in real time. This is very important in an open position. And by this way, you can easily add or close trading positions when necessary.

Once the open position meets your speculated profit or loss you can close the trade and when you close a trade, your profits or losses will be credited or debited from your account balance right away.

In the past, those who were not familiar with forex used a broker to trade currencies on their behalf. But thanks to advances in technology, the evolution of smartphones and many online trading platforms, it’s now possible to trade currencies directly as an individual.

Forex trading is margined or leveraged. Margin trading in forex involves placing a deposit in order to open and maintain a position for trading in one or more currencies. Leverage enables traders to perform a larger amount of money trading than what they may be willing or put up.

As an example, if you want to trade GBP 100,000 at 1% margin you need to have GBP 1,000 in your account. The rest of the money will be provided by the FX platform, company or the broker. The broker uses the $1,000 as a security deposit to compensate for the profit or loss occurring from your trading pairs. If the trader’s position worsens and their losses approach GBP 1,000, the FX broker may initiate something called a margin call.

When this happens, a FX broker will usually instruct the trader to either deposit more money into the account or to close out the position to limit the risk to both parties. In situations where accounts have lost substantial sums in volatile markets, the FX broker may liquidate the account and then later inform the customer that their account was subject to a margin call.

Forex trading is quite popular in the UK. When choosing a trader for you make sure that they are authorized by the Financial Conduct Authority (FCA), which is the financial regulatory body in the UK. Many popular forex brokers from around the world hold regulatory licenses with the FCA. So select a trustworthy one and open an account and fund the new brokerage account.

Then you need to fill out an order ticket in order to place a trade. If you have picked an online broker, you can practice trading in a demo account with virtual currencies until you are familiar with how the trading platforms work before funding your account with real money.

Like every financial market, supply and demand primarily control the price movements in the forex markets. Banks and other big investors want to pour in capital into economies with strong potentials. The forex trading market is very dynamic and highly liquid. Because of this liquidity, currency rates can quickly change in reaction to many factors and forex traders can take advantage of these market influences by trading.

Macroeconomic statistics, such as inflation, Interest Rates, Political stability and Public debts have a great impact on the value of currency and forex markets. Stock, bond, commodity, and other capital markets also have a strong influence on exchange rates. International trade numbers, such as trade deficits and surpluses, play a vital role in forex trading. So it is important to research the currency pair you have chosen. It will enable you to determine when a currency becomes weak or strengthen.

Thanks for reading the blog, we believe now you have a better idea on what is Forex Trading and how it works. Visit our other website to know more about our international courier service and air ticketing services.